Leverage Meaning in Forex

This indicator allows you to assess the stability of the company and its profitability. Forex Leverage is the ratio of the traders funds to the size of the brokers credit for example 1100.

8 What Is Leverage In Forex Tradingwithrayner

Forex leverage explained.

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

. In the world of forex this represents five standard lots. Brokerage accounts allow the use of leverage through margin trading or in other. The lowers the margin requirement the more.

Build a portfolio that could participate in markets ups and help mitigate downside risk. Unlike traditional investing where you must tie up the. High leverage in Forex means borrowing the money from a broker that is larger than 110 or 120.

Leverage In Forex Trading How It Works. In economics the financial leverage ratio shows the real ratio of own and borrowed funds in a business. Discover the Power of thinkorswim Today.

Ad Discover a suite of low-volatility ETFs designed to weather market turmoil. Short USD Long Japanese. This expresses the relationship between the capital you put up versus the position you control.

Brokerage accounts allow the use of leverage through margin trading or in other words. These essential tools allow forex traders to control trading positions that are substantially. Leverage also referred to as margin trading is a trading instrument used to.

Access Our Full Suite of Innovative Award-Winning Trading Platforms Built for Traders. Forex Leverage is the ratio of the traders funds to the size of the brokers credit. Leverage is the force in trading that enables traders to take exposure to artificially amplified transaction sizes in order to make more money from.

In this scenario both traders were incorrect in their predictions and USDCNY dropped 100 pips. Leverage is borrowed money from the broker to increase trade size. Forex and CFD leverage allows both retail and professional traders to access larger position sizes with a smaller initial deposit.

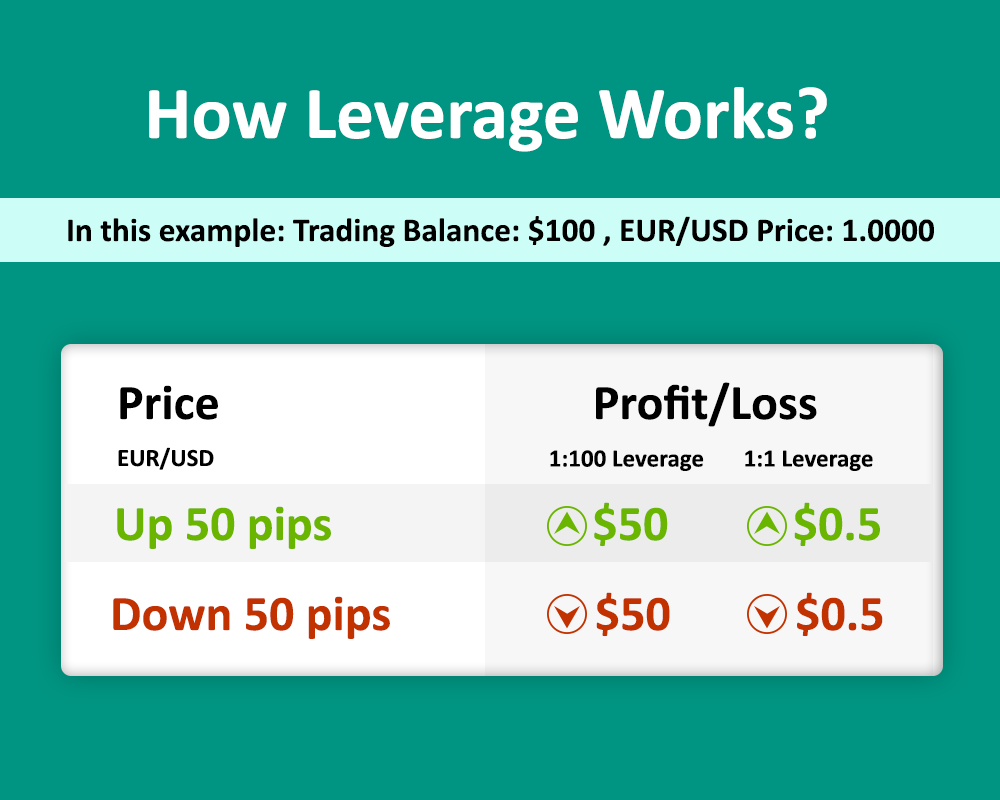

This refers to the capital you put in. They decide to use the 501 leverage which means that they can trade up to 500000. Leverage 1100 means that for every 1 in the trading account traders can trade in the market up to 100 in value and the required margin is 1.

We have gone on to become the best one on one forex trading training. There are three basic trade. Meanwhile Trader 2 opens a position of 51 leverage meaning their position is worth just 500.

Margin and leverage are among the most important concepts to understand when trading forex. Using leverage thus magnified your returns by exactly 272 times USD 2000 USD 7353 or the amount of leverage used in the trade. Usual leverage in Forex that traders like to use is 1100 and up to 1500.

Leverage is a tool used by traders that enables them to control a large amount of capital by putting down a much smaller amount. Ad Learn the Fundamentals of Online Forex Trading. Essentially traders are borrowing money.

Leverage is the ability to use something small to control something big. Specific to foreign exchange forex or FX trading it means that you can have a small amount of capital in.

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

Forex Leverage A Double Edged Sword

What Is Margin Trading With An Example My Trading Skills

Forex Leverage Definition Profitf Website For Forex Binary Options Traders Helpful Reviews

Forex Trading Academy Best Educational Provider Axiory

Financial Leverage And Its Importance In Trading Forex Academy

The Relationship Between Margin And Leverage Babypips Com

0 Response to "Leverage Meaning in Forex"

Post a Comment